-

Read time : 4 mins

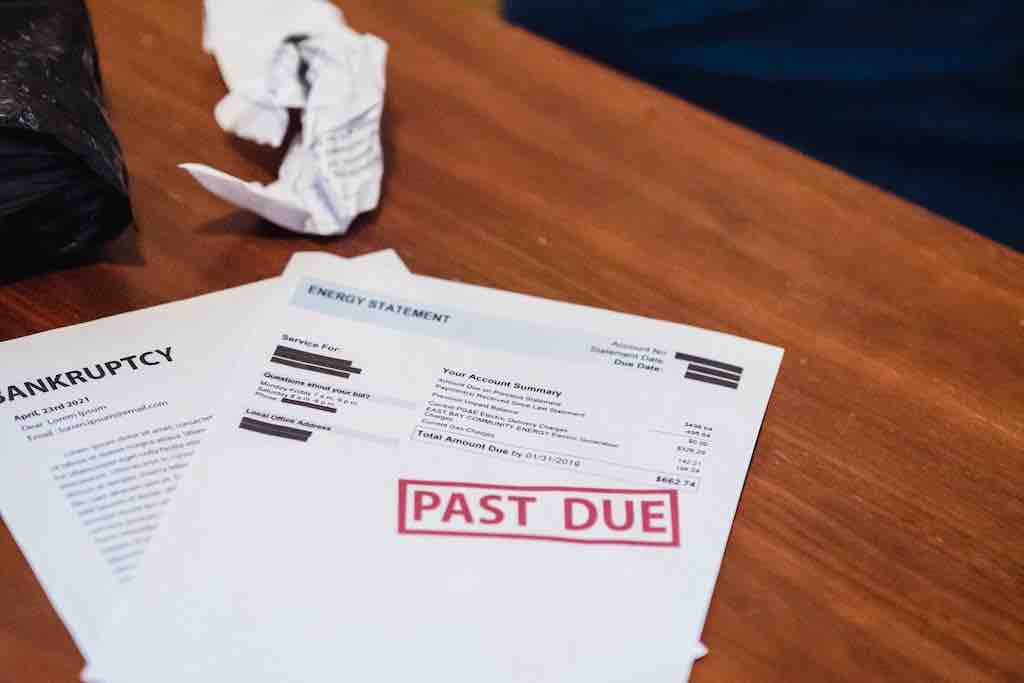

Read time : 4 minsFinancial Literacy Might Prevent You from Bankruptcy

(Photo by Nicola Barts)

Financial literacy is a critical skill that empowers individuals to make informed and responsible decisions regarding their finances. It involves understanding various financial concepts, such as budgeting, saving, investing, and debt management. Having a solid grasp of financial literacy can significantly impact one's financial well-being and help steer clear of financial pitfalls, such as bankruptcy. In this article, we will explore the importance of financial literacy, real-life examples of how it can prevent bankruptcy, and practical tips to improve your financial literacy.

The Importance of Financial Literacy

Financial literacy goes beyond simply knowing how to balance a checkbook or pay bills on time. It encompasses a comprehensive understanding of personal finances and the ability to make wise financial choices that align with your short and long-term goals. Being financially literate allows individuals to:

a. Make Informed Decisions: With financial literacy, individuals can assess financial products and services effectively. They can understand the terms, fees, and risks associated with various financial products like loans, credit cards, or investments.

b. Budget Effectively: Financial literacy empowers individuals to create and stick to a budget, ensuring they manage their income, expenses, and savings efficiently.

c. Manage Debt Responsibly: Understanding debt and its impact on personal finances helps individuals avoid overborrowing and manage existing debts responsibly.

d. Save and Invest Wisely: Being financially literate enables individuals to evaluate different saving and investment options, maximizing their potential returns and long-term financial security.

Real-Life Examples of Financial Literacy Preventing Bankruptcy

a. Avoiding Overspending: A financially literate individual knows the importance of living within their means and avoiding impulsive spending. By budgeting and tracking expenses, they can prevent accumulating excessive credit card debt, which often leads to financial crises and potential bankruptcy.

b. Making Informed Investment Decisions: Financial literacy empowers individuals to research and understand investment opportunities thoroughly. As a result, they can make informed choices that align with their risk tolerance and financial goals, avoiding high-risk ventures that could jeopardize their financial stability.

c. Navigating Unexpected Financial Hardships: Life is unpredictable, and financial hardships can arise at any time. A financially literate individual is more likely to have an emergency fund in place to weather unexpected expenses, reducing the risk of resorting to high-interest loans or credit cards that can lead to overwhelming debt.

d. Understanding Mortgage and Loan Terms: Homeownership is a significant financial decision. A financially literate individual would thoroughly comprehend mortgage terms, interest rates, and payment schedules, ensuring they can afford the monthly payments without stretching their finances to the breaking point.

Practical Tips to Improve Financial Literacy

a. Educate Yourself: Take advantage of the numerous online resources, books, and workshops available to enhance your financial knowledge. Topics can range from basic budgeting to advanced investing strategies.

b. Set Financial Goals: Establish short-term and long-term financial goals, such as saving for an emergency fund, paying off debts, or investing for retirement. These goals will help you stay focused and motivated to improve your financial situation.

c. Seek Professional Advice: Consult with financial advisors or planners to gain personalized insights into your financial situation and receive expert guidance on achieving your financial goals.

d. Monitor Your Credit Score: Regularly check your credit score and report to identify areas that may require improvement. A good credit score opens doors to better financial opportunities.

e. Learn from Others: Engage in financial discussions with friends, family, or financial support groups. Hearing real-life experiences and lessons can be invaluable in shaping your financial decisions.

SHOP NOW

Financial literacy is a powerful tool that can significantly impact your financial well-being. By understanding various financial concepts and applying this knowledge to your daily life, you can make informed decisions that prevent financial hardships and bankruptcy. Real-life examples demonstrate how financial literacy empowers individuals to avoid overspending, make wise investment choices, navigate unexpected financial challenges, and understand debt responsibly. Embrace the importance of financial literacy and take proactive steps to improve your financial knowledge. By doing so, you'll gain the confidence and skills needed to secure a stable financial future for yourself and your loved ones.(inp-paserba-health wealth and quality lifestyle)

Tagged: make moneyYou might like

Financial Literacy Might Prevent You from Bankruptcy

WORLD NEWS

Make Money

The Best Online Platforms for FreelancersFriday, January 3, 2025 - 21:30How To Easily Make Money Taking Online SurveysMonday, March 2, 2020 - 04:31The Importance of Financial LiteracySunday, March 1, 2020 - 03:35These are 5 Easiest Ways to Make Money OnlineSunday, March 1, 2020 - 03:30Fashion

Wednesday, March 1, 2023 - 03:30As the fashion industry constantly evolves, each year brings its own set of trends and influences. Let's explore the key differences ...INSPIRATION

amz-002

Detox Your Body

Friday, March 6, 2020 - 13:40Detox drinks have gained popularity in recent years as people seek ways to cleanse their bodies and support their weight loss journey.amz-001

Paserba - Life Inspiration, Health, Wealth and Quality Lifestyle

Recent posts

American Airlines Flight 5342 Collides with Helicopter Over Potomac River; Search and Rescue Operations IntensifyFriday, January 31, 2025 - 01:01DeepSeek's Rapid Rise: A New Contender in the AI IndustryMonday, January 27, 2025 - 20:01Why HIV Has No Cure Yet: The Science Behind the StruggleTuesday, January 14, 2025 - 12:31Choosing the Right Baby Car Seat: What You Need to KnowThursday, January 9, 2025 - 13:45How I Dropped Pounds Without Starving or OvertrainingWednesday, January 8, 2025 - 11:23

Tags